It can be very complicated to manage your mailing equipment agreements because there are so many different charges and often time avoidable fees can arise. This gets multiplied if you are responsible for multiple locations. I have helped accounts paying tens of thousands of dollars in avoidable fees because they did not understand how they were being billed. In this article we will give you the tools to understand these fees and to make sure you are only paying for the services required.

The two main areas where these fees arise are in your postage accounts and with your leases. This is not the vendors trying to trick you, since these terms are spelled out in their standard terms and conditions. The issue is - who really reads through those terms carefully. Also, there is typically a disconnect between the person who signs the agreement and the department that pays the bills. The good news is that these fees are avoidable!

The two main areas where these fees arise are in your postage accounts and with your leases. This is not the vendors trying to trick you, since these terms are spelled out in their standard terms and conditions. The issue is - who really reads through those terms carefully. Also, there is typically a disconnect between the person who signs the agreement and the department that pays the bills. The good news is that these fees are avoidable!

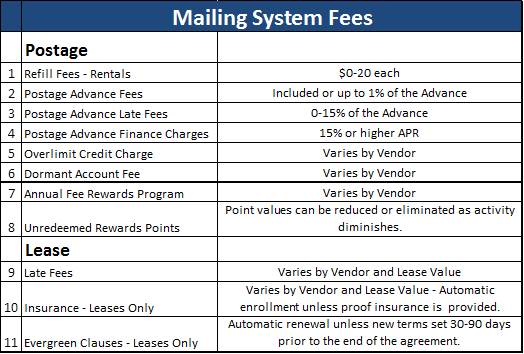

Postage

1. Refill Fees- ($0-20 each) -- You need to check to see if you are charged a refill (Reset) fee for your meter. This is a charge when you add postage into the meter. This could be a flat fee or a charge based on the amount you refill. By knowing the rules, you can plan a strategy of how much you want to refill based on your usage levels. Also, you may want to look at future renewals that include unlimited refills.

2. Postage Advance Fees (Up to 1% of the Advance) -- This is a fee for borrowing funds to go into the meter vs. having the money sitting on hand in a prefunded account. Many leases will include unlimited advances but you need to check to make sure that you understand any charges. If you are paying this fee, you want to consider prefunding your postage account vs. borrowing the funds and paying after use.

3. Postage Advance Late Fees (0-15% of the advance) -- Postage Advance Accounts are just like any credit card. They are great to consolidate all of your charges each month and if you pay your balance in full, you get a free float of money. The problem happens with when you cannot pay your bill in the 25-30 days they provide. Many larger companies cannot turn an invoice around that quickly, and these fees can multiply.

4. Postage Advance Finance Charges (15% or higher APR) -- To make matters worse, when these Postage Advance Accounts are not paid in full by the due date, any outstanding balance are assessed finance charges of 15% or more. The issue is many companies continually do not pay their balance in full, and the finance charges keep coming.

5. Over Limit Credit Charge -- When you have a Postage Advance Account, they set an account limit that states the maximum amount of money you can take out. If you need more money for a postage spike or because a previous invoice was not paid in full, you can get an "Over Limit Charge". It is a best practice to make sure your credit line can cover you for 3-4 months of use. You can go to your mailing vendor and request a credit line increase if needed.

6. Dormant Account Fee -- If the postage sits for over a year with no activity in either your prepaid or advance postage account, the vendors can charge fees for keeping the account active. We typically see this when money was left in a prepaid account but the client is drawing from an advance account or when the meter was turned in but the postage was never redeemed.

7. Enhanced Rewards Program Annual Fee -- Pitney Bowes has a no fee rewards program that they offer to all of their Postage Advance Account customers where you accumulate points for the postage, supply purchases and other spends. It is a very good program where you can use points for free postage, supplies or personal gifts. They also have an enhanced rewards plan that has an annual fee, where the points can grow at a faster rate and where there are other added values. If you are paying for this enhanced program, make sure you understand the terms and benefits to make sure it is right for you.

8. Un-Redeemed Rewards Points -- We find that many customers have unknowingly accumulated large amounts of loyalty points that often time go unredeemed. You can find out how many points you have by looking at their Advance Postage Account statements. They will give you a website you can sign into to redeem your points. We have found that if the advance account goes dormant or terminates, these points can be reduced or eliminated, so it is a good idea to track your point balances.

2. Postage Advance Fees (Up to 1% of the Advance) -- This is a fee for borrowing funds to go into the meter vs. having the money sitting on hand in a prefunded account. Many leases will include unlimited advances but you need to check to make sure that you understand any charges. If you are paying this fee, you want to consider prefunding your postage account vs. borrowing the funds and paying after use.

3. Postage Advance Late Fees (0-15% of the advance) -- Postage Advance Accounts are just like any credit card. They are great to consolidate all of your charges each month and if you pay your balance in full, you get a free float of money. The problem happens with when you cannot pay your bill in the 25-30 days they provide. Many larger companies cannot turn an invoice around that quickly, and these fees can multiply.

4. Postage Advance Finance Charges (15% or higher APR) -- To make matters worse, when these Postage Advance Accounts are not paid in full by the due date, any outstanding balance are assessed finance charges of 15% or more. The issue is many companies continually do not pay their balance in full, and the finance charges keep coming.

5. Over Limit Credit Charge -- When you have a Postage Advance Account, they set an account limit that states the maximum amount of money you can take out. If you need more money for a postage spike or because a previous invoice was not paid in full, you can get an "Over Limit Charge". It is a best practice to make sure your credit line can cover you for 3-4 months of use. You can go to your mailing vendor and request a credit line increase if needed.

6. Dormant Account Fee -- If the postage sits for over a year with no activity in either your prepaid or advance postage account, the vendors can charge fees for keeping the account active. We typically see this when money was left in a prepaid account but the client is drawing from an advance account or when the meter was turned in but the postage was never redeemed.

7. Enhanced Rewards Program Annual Fee -- Pitney Bowes has a no fee rewards program that they offer to all of their Postage Advance Account customers where you accumulate points for the postage, supply purchases and other spends. It is a very good program where you can use points for free postage, supplies or personal gifts. They also have an enhanced rewards plan that has an annual fee, where the points can grow at a faster rate and where there are other added values. If you are paying for this enhanced program, make sure you understand the terms and benefits to make sure it is right for you.

8. Un-Redeemed Rewards Points -- We find that many customers have unknowingly accumulated large amounts of loyalty points that often time go unredeemed. You can find out how many points you have by looking at their Advance Postage Account statements. They will give you a website you can sign into to redeem your points. We have found that if the advance account goes dormant or terminates, these points can be reduced or eliminated, so it is a good idea to track your point balances.

Lease

9. Late Fees -- Just like postage accounts, lease invoices will have late fees that can accumulate when the bill is not paid in full by the due date. The fee amount can vary based on the vendor and the lease amount.

10. Equipment Insurance -- Most of the mailing vendors will add an equipment protection policy to their leases that can be removed by providing proof of insurance. The vendors do this because the equipment is owned by their leasing company and they need to make sure it is covered for fire, theft, flood, etc. We find that many entities never send in the proof of insurance and these charges linger.

11. Evergreen Clauses -- I left this one for last because I think it is the most important. We see most of the mailing vendors putting these into their agreements. This means that if you do not let the leasing company know what you want to do with the equipment 30-90 days prior to the end of the agreement, that they will automatically extend the lease for a period of time. Since the end of lease date is not visible on most invoices, many companies may not know when their lease is up and may encounter these automatic extensions. Make sure you reach out to the vendor to know the exact end of lease date and for a listing of the different options you may want to consider for the future. These typically include:

a. Lease new equipment.

b. Renew existing equipment at the same or different rate.

c. Buyout the current equipment.

d. Terminate the lease and have the equipment removed.

10. Equipment Insurance -- Most of the mailing vendors will add an equipment protection policy to their leases that can be removed by providing proof of insurance. The vendors do this because the equipment is owned by their leasing company and they need to make sure it is covered for fire, theft, flood, etc. We find that many entities never send in the proof of insurance and these charges linger.

11. Evergreen Clauses -- I left this one for last because I think it is the most important. We see most of the mailing vendors putting these into their agreements. This means that if you do not let the leasing company know what you want to do with the equipment 30-90 days prior to the end of the agreement, that they will automatically extend the lease for a period of time. Since the end of lease date is not visible on most invoices, many companies may not know when their lease is up and may encounter these automatic extensions. Make sure you reach out to the vendor to know the exact end of lease date and for a listing of the different options you may want to consider for the future. These typically include:

a. Lease new equipment.

b. Renew existing equipment at the same or different rate.

c. Buyout the current equipment.

d. Terminate the lease and have the equipment removed.

Tips to Avoid Fees:

Know what is included in your agreements - It is very important to know what is included in your lease, purchase and rental agreements and to understand your terms. Is the meter rental, maintenance agreement, rate change protection as well as meter resets and postage advances included in your lease or are they charged separately? If the equipment is owned or rented, are postage resets and advances included, or are they a separate charge?

Gain online visibility to your accounts -- Most vendors will give you a way to log in and see your different expenses for equipment and postage. Many will even allow you to pay bills online. This is a very effective way to have consolidated visibility to your spend.

Pay Bills On Time -- This may sound obvious, but the terms that these bills need to be paid may not match up with your internal accounts payable cycle. This is the main reason that fees accrue and it is important to know the ââ¬Å"Netââ¬ââ terms and conditions. Many of the charges in the table above are because bills were not paid on time.

Get Rid of Vendor Provided Equipment Insurance -- All leases require proof of insurance or they will assign a type of plan that covers fire, theft, damage, etc. This protection will automatically be assigned until you send proof that you have insurance for your office and equipment.

Prefund Postage over Advancing Funds -- There are so many fees that can arise by advancing funds, that a simple way to avoid them is to send money in ahead of time. For smaller and mid-size mailers, I typically recommend that you always have a monthââ¬â¢s postage funds sitting in idle. For larger mailers there are ACH models to have funds deposited directly from your bank account in a same day or next day mode.

Check End of Lease Options -- Make sure you understand your options at the end of the lease. Some agreements have evergreen clauses that can automatically renew for a period of time if you do not instruct the vendor by a specific date prior to the end of lease.

I have spent the majority of my career helping large customers manage their mailing equipment to make sure they are getting the highest service from their vendors at the lowest costs and avoiding these types of charges. It does not have to be difficult to avoid these fees, but it does take understanding the details of what you are paying, the terms of your agreements and when items need to be paid. Hopefully the information above will help you eliminate avoidable fees for the future.

Adam Lewenberg, CMDSS, MDC, President of Postal Advocate Inc., runs the largest Mail Audit and Recover firm in the United States. Their mission is to help entities with large numbers of locations reduce mail related expenses, recover lost postage funds, and simplify visibility and oversight. So far in 2013, they have helped their clients save an average of 63% and over $2.5 million on equipment, fees and lost postage. He can be reached at (617)372-6853 or adam.lewenberg@postaladvocate.com.