One of the keys to staying competitive is understanding your competition. But another key to staying competitive is understanding not only how you compete in the market but where the market is heading overall. To better understand the print service provider market's direction, Madison Advisors is conducting two Market Pricing Studies for print and mail providers in

The study comprises four major areas of analysis:

n Indu

n Market Trends, Madison Advisors' analysis of the late

n Market Pricing, descriptions of applications and pricing in the

n Provider Overviews, brief reviews of key service providers including service offerings and capabilities. The following organizations are presented in the

The Service Provider Market Pricing Study presents the results of Madison Advisors' extensive research and analysis related to competitive pricing of the industry's leading organizations.

Value Proposition

Madison Advisors conducted the study because several significant factors are affecting the current direction of the market, including:

§ Industry Consolidation: Consolidation is creating a small group of top-tier providers, but the number of providers in regional and local markets remains robust.

§ Outsourcing and Consulting Services: With the exception of banking, the one vertical in which there is a clear trend for small- to mid-tier banks to outsource, most vertical markets swing between outsourcing print and building print production over the course of several years.

§ Customer Portals: As many of the customer portals are new, print service providers struggle with pricing for the services offered through a portal. Madison Advisors expects pricing for these services to migrate to a per-item or per-access fee as portals become widely adopted by clients.

§ Digital Color Print Production: The adoption of digital color by clients has finally hit the levels suggested 5 years ago. Print service providers base the price of digital color printing primarily on the device. Average per-page prices for toner-based devices are four times higher than prices for inkjet-based devices.

§ Personalization Services: Personalized messaging is new to many corporate clients so most print service providers consider personalized messaging to be a differentiator. Madison Advisors expects the pricing models to change and standardize within the next 2 years as messaging becomes more commonplace.

Lay of the Land

For the study, Madison Advisors surveyed major print service providers in the high-volume, transactional print market. Madison Advisors defines print service providers as organizations that produce and distribute documents to corporate clients. Print service providers receive electronic files from clients, which the service provider prints and inserts into envelopes. Most print service providers also submit documents to the post office or a presort operation for co-mingling with other clients' mail to reduce postage costs.

The transactional market consists of large-volume batch documents, including statements and invoices, which are typically produced on a daily, weekly, or monthly production cycle. Transactional documents contain personal financial or medical data that requires secure handling and accurate delivery.

In addition to traditional print and mail services, many of the major print service providers offer additional data and document processing services. Print service providers may also offer document archiving and electronic presentment of the printed documents to complete the document lifecycle.

The Players

For the purposes of the study, Madison Advisors bases its market segmentation on print production capacity and distribution of production facilities. Print capacity determines the service provider's ability to support high volumes of transactional print production within a narrow timeframe. Federal and state regulations require many of the financial services applications, which are the largest source of transactional print volume, to be produced and mailed within five business days of month-end. Print service providers schedule production equipment to meet the cyclical production peaks imposed by these regulations.

Distributed production operations enable print service providers to route production across multiple sites. Service providers may reduce mail delivery times by producing jobs at the facility that is nearest to the mail-piece recipient. Service providers also use distributed sites for redundancy and disaster-recovery purposes.

Madison Advisors organizes the print service provider market into three segments - national, regional, and local. There are only a few large national print service providers with both a depth of production capacity and breadth of facility distribution. These organizations target large financial services companies and billers within the telecommunications, utilities, and healthcare markets. Regional service providers have a large equipment base for production, but usually focus on one or two vertical markets and offer specialized applications, such as plastic card production or lockbox operations. Local print service providers generally have the capacity and expertise to support local, smaller billers across a range of vertical markets.

The Reason You've Read This Far

The Market Pricing section of Madison Advisors' Service Provider Market Pricing Study provides descriptions of applications and pricing in the study, with detail on vertical/application market focus and core competency for each service provider in the study. Specifically, we present marketing pricing in six key areas: Design Services, Digital Print, Insertion, Auditing Services, Postal Services, and Electronic Presentment Services.

Let's take a look at Digital Print.

For the purposes of the study, digital print includes the production of different transactional documents from client-supplied data files. Madison Advisors gathered services pricing for five applications across four vertical markets - financial services, utilities, telecommunications, and insurance.

The study provides details on each of the sample applications used during the data-collection process. Madison Advisors collected data from each print service provider using the same sample application descriptions.

Digital print pricing is the most dynamic section of the report. Madison Advisors' research indicates that while the pricing models for other services continue to mature, most print service providers use one of two digital print pricing models.

Separate pricing for the first page and additional pages is used by some national print service providers, while smaller providers use a per-page pricing model. Participants provided per-page pricing for the study.

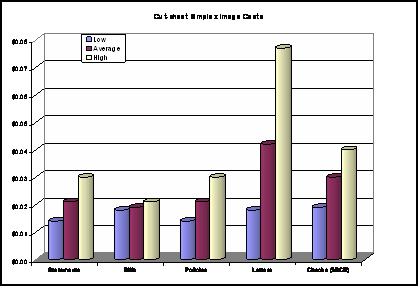

The figures in the graphic below present the low, average, and high pricing for cut-sheet simplex images.

The Service Provider Market Pricing Study is a valuable tool for under

Beth Kujawski bethkujawski@madison-advisors.com is the senior editor with